Changes to terms and conditions in consumer contracts

June 15, 2020

The restrictions introduced due to COVID-19 to limit the spread of the virus has led to wide-spread cancellation or deferral of events and services, which has had a significant impact on consumers and businesses. For many businesses who provide services to consumers, their standard form contracts will contain terms specifically setting out the rights of both parties in the event of a cancellation or a termination of the service by either party, and the obligations on each party as a result of the cancellation or termination.

However, the unforeseen nature of the COVID-19 situation has brought about unprecedented circumstances and, as a result, businesses may be considering changing the terms and conditions in their standard form contracts, particularly in relation to cancellations, rescheduling and refunds.

The CCPC is concerned that businesses may change or add additional terms and conditions in existing consumer contracts, without advance notification to consumers or an opportunity for them to exit the contract without penalty if they do not wish to accept the business’s proposed change. Seeking to bind existing consumers to new or amended terms without the consumer’s agreement, constitutes an unfair commercial practice under the Consumer Protection Act 2007. Such newly inserted terms without consumer agreement are also likely to be unfair under the Unfair Terms in Consumer Contracts Regulations.

Under consumer protection law, contracts must be fair and balanced, protecting the interests of both parties. Businesses are expected to take consumers’ legitimate interests into account when drafting their standard form contracts.

The CCPC has published guidelines to assist businesses in ensuring that consumers are not bound by unfair terms in their contracts, a summary of which is as follows:

Unfair Terms Regulations

The European Communities (Unfair Terms in Consumer Contracts) Regulations 1995, as amended, (Unfair Terms Regulations) provide specific protections to consumers who enter into standard form contracts for goods or services. A standard form contract is a contract between two parties, where the terms and conditions of the contract are set by one of the parties (usually the business), and the other party (the consumer) has little or no opportunity to negotiate or change the terms.

The Unfair Terms Regulations act as a control against the use by businesses of unfair terms in their standard form contracts with consumers. They are a set of legal rules and principles which require businesses to act in good faith, to deal openly and fairly with consumers to ensure contract terms do not mislead or cause surprise and to present those terms to consumers in plain language. To demonstrate the meaning of fairness it also provides a non-exhaustive list of terms which may be unfair. Unfair terms are those terms which significantly imbalance the contract to the detriment of the consumer. In effect, a term is unfair if it puts the consumer at an unfair disadvantage or is harmful to the consumer’s interests.

Here are a number of examples of -potentially unfair terms:

- Unequal Obligations: Terms which impose unequal obligations, i.e. the consumer is bound to perform the contract but not the business.

- Retaining pre-payments: Terms which permit the supplier to retain pre-payments in the event of cancellation/termination without a valid reason. Where the amount of such a pre-payment is in excess of a genuine pre-estimate of the business’s loss.

- Disproportionate Penalties: Terms which act so as to impose disproportionate penalties on the consumer.

- Unfair cancellation/termination clauses.

- Contract renewal without agreement: Terms which provide for an automatic renewal of a contract without the consumer’s agreement.

- ‘Hidden’ terms: Terms not brought to the consumer’s attention. Where a particular contract term is likely to have important consequences for the consumer, these must not be hidden and should be flagged from the outset to the consumer.

- ‘Entire agreement clause’: Terms which rule out earlier commitments made by the business or his or her agent.

- Unilateral right to change T&Cs: Terms which allow the business a unilateral right to vary the terms of the contract without advance notification to the consumer, time to consider its implications and an opportunity to exit the contract without penalty.

- Unilateral right to interpretation: Terms that provide the business with a unilateral right to interpret his or her own contractual obligations.

- Unilateral right to transfer: Terms which allow the business a unilateral right to transfer the contract.

- Restrictions to legal action: Terms which restrict or hinder legal actions or the exercise of a legal remedy by the consumer.

Even if a consumer accepted the terms when entering into the contract, this does not necessarily mean that he or she is bound by unfair terms. Such terms are never valid if they are in breach of the Unfair Terms Regulations. An unfair term is not binding on a consumer.

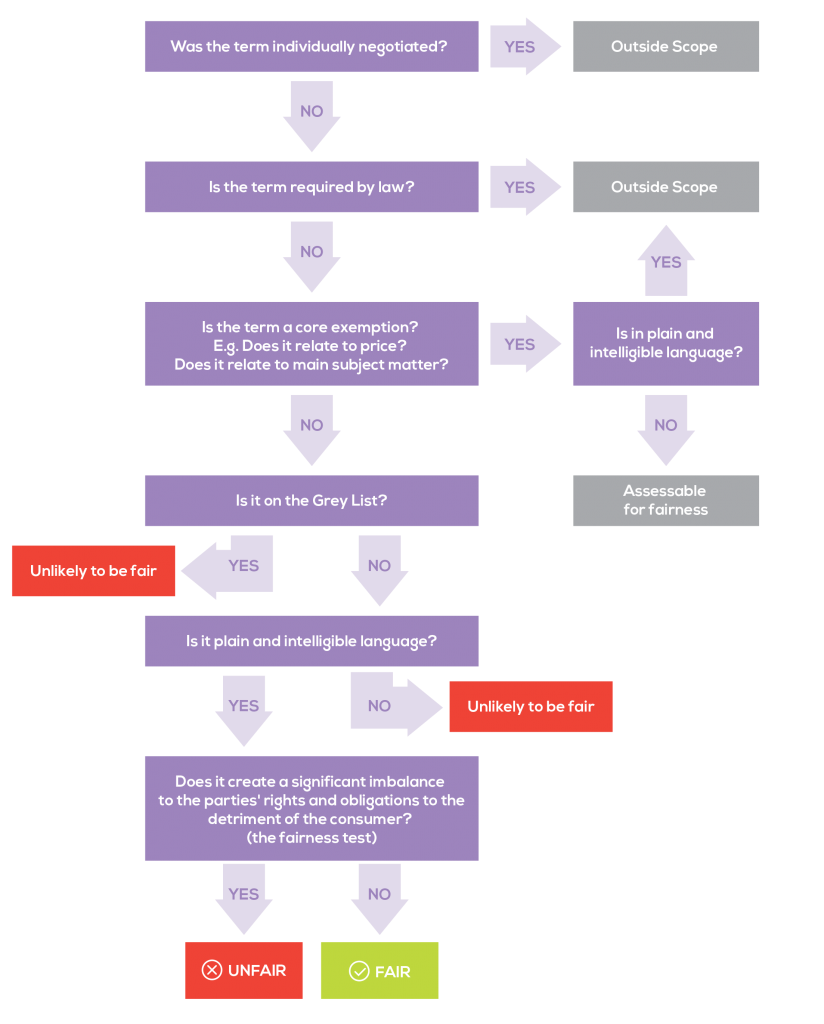

The below is a helpful diagram which sets out the process which a business should follow when drafting terms in a contract to ensure they comply with the Regulations.

Further information about this legislation is contained in our Guide to Unfair Terms in Contracts for Businesses.

Return to News