CCPC publishes Annual Mergers and Acquisitions Report 2025

January 12, 2026

The Competition and Consumer Protection Commission (CCPC) has published its Annual Mergers and Acquisitions Report 2025, providing details of the mergers and acquisitions notified to, and reviewed by, the CCPC throughout the year.

Growth in merger notifications and continued efficiency

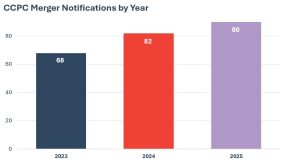

There was a 32% increase in merger notifications from 2023 to 2025. Two-thirds of mergers reviewed in 2025 were dealt with under the CCPC’s Simplified Merger Notification Procedure (SMNP). In 2025, the average number of working days to reach a Phase 1 determination in non-extended cases was 17.05. For mergers dealt with under the SMNP, the Commission reduced the average working days from notifications to determination from 13.3 in 2024 to 12.5, underscoring the continued success of the SMNP.

Organisationally, 2025 marked a major milestone with the restructuring of the CCPC’s competition functions. The former Competition Enforcement & Mergers Division was split into two dedicated divisions – the Mergers Division and the Antitrust Division, with Alan Scarlett appointed the CCPC’s Director of Mergers in July. This change ensures senior resourcing and a sharper focus on merger review, reflecting the growing complexity of transactions and the need for specialised expertise.

Formal commitments secured to address competition concerns

In 2025, the CCPC secured formal commitments from merging parties in five cases to address competition concerns arising from mergers in the telecommunications, fuel retail, hospitality, waste management, and wholesale grocery supply sectors. These commitments are designed to ensure that the mergers do not result in significantly reduced competition. The commitments included divestments of assets and customer contracts, certain restrictions regarding future acquisitions, undertakings regarding the future management and operation of businesses, and safeguards to prevent anti-competitive information sharing.

2025 key statistics

- 90 mergers were notified in 2025, up from 82 in 2024, and from 68 in 2023.

- The CCPC issued 91 determinations, including 12 in relation to cases carried over from 2024.

- In 2025, the CCPC made 58 determinations (approximately 64%) under the CCPC’s Simplified Merger Notification Procedure. These determinations were made within an average of 12.5 working days from notification of the merger (a reduction from 13.3 in 2024).

- Five Phase 2 investigations were concluded in 2025. Two transactions were cleared unconditionally, and three were cleared with remedies.

- Eight media mergers were notified to the CCPC in 2025, compared to three in 2024. Six were cleared unconditionally, and two have been carried over in 2026.

Commenting on the publication of the report, Úna Butler, Member of the Commission, said:

“Our goal is to ensure that competition is protected to the benefit of consumers and to that end, it was another busy year for merger review in Ireland. The CCPC issued 91 determinations in 2025. That’s a 34% increase in determinations annually since 2023.

We also concluded five Phase 2 investigations this year, all of which required detailed economic analysis and extensive engagement with stakeholders.”

Looking ahead to 2026 and beyond, Úna Butler continued:

“One key element of a merger review regime is the need to ensure efficiency. In 2025 the CCPC established a standalone Mergers Division, ensuring senior resourcing and a sharper focus on merger review. The creation of this new Division will support the delivery of a sustainable and effective merger review regime into the future.

As we move forward, the CCPC hopes to see the financial thresholds for mandatory notification of mergers in Ireland increased so that we can focus resources on transactions which are more likely to raise competition issues.

These thresholds were last updated in 2019 and, in light of considerations such as inflation during the intervening time period, the introduction of new merger call-in powers and the Government’s commitment to reduce regulatory burden on businesses, the CCPC feels now is the time to reconsider the merger thresholds.”

View the full report at CCPC Merger and Acquisitions Report 2025.

Return to News